A Mortgage Experience Like No Other

Wherever you are in life, we make your dream of affordable homeownership achievable! Create a custom mortgage payment to help you land your first home or vacation home. You can even refinance your home loan to reduce your payment or change your loan term.

Affordable Mortgage Rates

1 APR = Annual Percentage Rate. The displayed APR represents the lowest possible rates available. Rates are based on credit history and are subject to change without notice. Fixed rates displayed based on a $250,000 loan, with a 20% downpayment. Minimum loan amount is $300,000.

1 APR = Annual Percentage Rate. The displayed APR represents the lowest possible rates available. Rates are based on credit history and are subject to change without notice. Fixed rates displayed based on a $250,000 loan, with a 20% downpayment. Minimum loan amount is $300,000.

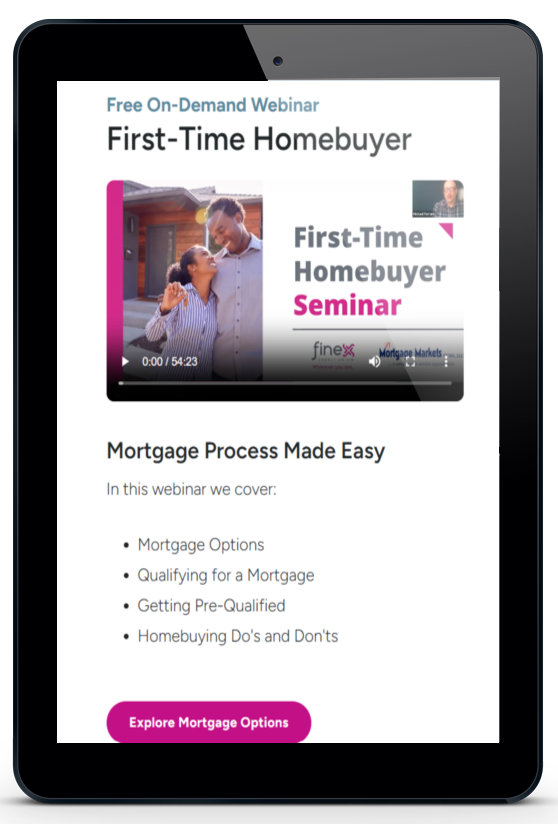

First Time Home Buyer?

Customize Your Mortgage & Payment

Wherever you are in your home-buying journey, we are here for you and will be by your side every step of the way. Saving money for you and your family is important! Our mortgage options give you control over finding the perfect mortgage payment that fits your unique needs. Ready to get pre-approved to lock in your rate? Get in touch with us now!

100% Financing

Flexible Terms

Expert Advice

Meet Your Personal Mortgage Advisor

- Expert Trusted AdviceWe are here to help guide you through the entire mortgage process.

- Custom Mortgage OptionsWe are with you every step of the way providing solutions to your unique needs.

- Relationship Not Just a TransactionWe have a passion for helping people like you to look out for your best interest.

Home Loan Options: Find Your Match

Conventional Mortgage Options

A wide range of home buyers and property types qualify as conventional mortgages. While not part of a specific government program, Finex Credit Union's conventional mortgages still provide an affordable loan option to secure your dream home.

- 10 - 30 year fixed terms.

- Adjustable rate mortgage options.

- No down payment is required.

- Borrow the entire amount of the cost of your new home (100% financing).

FHA Loan

If you are a first time home buyer, working to build your credit score, or trying to save for a down payment, a FHA loan could be the perfect mortgage for you!

- Low down payment options.

- Low credit score requirements.

- Mortgage must be for your primary residence, no second homes or investment properties.

VA Loan

If you are an eligible military service member, a VA loan can help you buy, build, or improve a home while offering you better terms than a typical home loan. Looking to refinance your current home loan? A VA loan can help with that too!

- No down payment required.

- No Private Mortgage Insurance (PMI) required.

- Lower credit score requirements.

How Much House Can I Afford?

We Have A Mortgage Solution For You!

One Step Closer To Your New Home

If you're a Connecticut first time home buyer searching for an affordable mortgage, you can save big with a Finex Credit Union FHA loan. Apply online 24/7 and stash away your extra savings for your next "first!"

- Low down payment requirements.

- No need for a perfect credit score.

- Relax and let us handle the details.

- Apply online 24/7 from anywhere.

Refinance Rates That Save You More

When mortgage rates and refinance rates are lower than what you are currently paying, you can choose to refinance. Refinancing can help by:

- Reduce your monthly mortgage payment by refinancing with a longer term.

- Pay off your mortgage faster by refinancing with a shorter term.

- Consolidate your debt or make improvements by using the equity in your home.

A Loan That's Just The Right Size

If the kids are out of the house and it's time to downsize, look no further than Finex Credit Union! We have the rates and terms you need to stay on budget with your next home purchase.

- 10 - 30 year fixed terms.

- Adjustable rate mortgage options.

- No down payment is required.

- Borrow the entire amount of the cost of your new home (100% financing).

What our members are saying...

Scott

Dawn

Thomas

Mortgage Resources Just for You

Mortgage Wire Fraud: Here’s What You Need to Know

As phishing scams become more sophisticated, instances of mortgage wire fraud are on the rise, and homebuyers risk losing their down ...

Getting a Mortgage: 5 Signs You're Truly Ready to Purchase a Home

While most people dream of owning a home of their own, it's crucial to make sure that you're ‘truly ready’ to become a homeowner ...

Winter-Ready Living: 8 Areas in Your Home that Require Winterizing

Part of being a homeowner is being prepared when the weather can impact your house. While it is a good idea to be ready for any ...

Frequently Asked Questions

Does it make financial sense to rent or buy a home?

We get the question a lot, but there's no right or wrong answer as it depends on a variety of factors. To help you determine this, contact our Mortgage Experts, they will give you the guidance and expert advice you are looking for.

How can I determine what I can afford?

For starters, you can use our home affordability calculator to get an estimate of how much house can fit comfortably within your budget. Furthermore, you can reach out to us, and we can tell you exactly what you can be pre-approved for before you go house hunting.

How do I get pre-approved?

We make the process easy. Contact our Mortgage Experts, to get pre-approved so you are armed and ready when you start shopping for a home.