A Youth Checking Account To Help Build & Establish Credit

It's never too early to open your teen's bank account and help start money management skills. If you are over 18, we have unique benefits to establish and build your credit!

Start Your Journey and Start Saving

Open Your Checking Account Online:

Excel24 Jr. Teen Checking Account

- No Monthly Fees

- No Minimum Balance

- Bank Securely

- Debit Card with Surcharge-Free ATM Access

Free Debit Card

No Monthy Fees

Enjoy our Excel24 Junior Teen Checking Account with no fees so your child starts managing money without any worries.

Peace of Mind

Excel24 Youth Checking Account

This checking account helps build credit for the average 18-24 year old. We'll help you get started with the right tools to establish and build a strong credit score! Open your account online today.

- Get Paid One Day Early1

- Bank Wherever You Are

- Fraud Monitoring 24/7

Expert Advice

We'll send you advice and updates on your credit score to keep you on the right track!

1 Early access to direct deposit funds depends on the timing of the submission of the payment file from the sender.

Budgeting Templates That Actually Work!

Which Checking Account is Right For You?

Start your finances off on the right foot with a Young Adult or Teen Checking Account. Establish strong financial habits and build your credit for the first time when you open your Checking Account online today!

Excel24 Jr. Teen Checking Account

- For ages 13-17

- Parent/Guardian required as joint account holder

- Daily limits ($500 ATM and $1,000 point of sale)

- Free Online Banking

- Free Mobile App banking

- No monthly fees

- Access to over 55,000 surcharge-free ATMs

- Checks available by request

Excel24 Youth Checking Account

- For ages 18-24

- $200 Cash Rebate when you get an Auto Loan with us2

- 3.00% APY Savings Account rate3

- Free Online Banking

- Free Online Bill Pay

- Free Mobile App banking

- No monthly fees when requirements are met4

- Access to over 55,000 surcharge-free ATMs

2: May not be combined with other promotional rates or rebates. 3: 3.00% APY rate compounded monthly will be paid on balances up to $3,000 if all requirements met. If not met, then basic share rate applies. Above $3,000 rate of 0.2% APY applies. 4: Requirements: direct deposit minimum of $200 per month, use of eservices, and at least three debit card POS transactions each month. See checking disclosures for full account details.

Credit Monitoring and Money Management With Mobile Banking

-

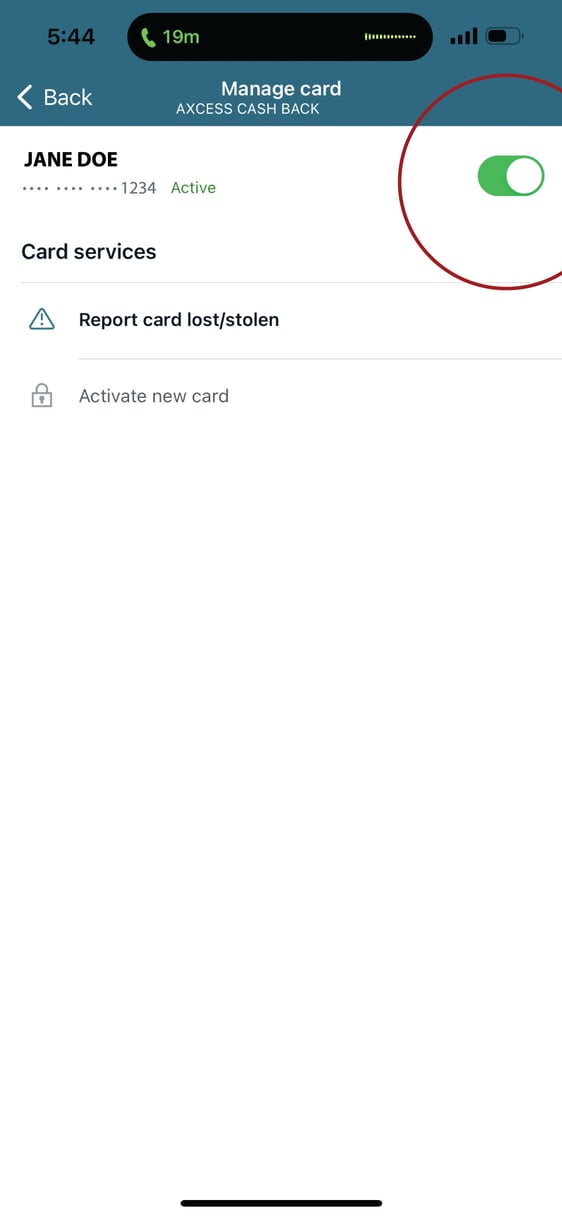

Control Your Cards

Enjoy the peace of mind while still giving your kids the freedom to learn money management. Easily lock and secure your misplaced card when needed.

-

Chat With Us

Chat with our member support team in real-time through the Finex Mobile Banking App. It's safe, secure, and available for you wherever you are!

-

Monitor Your Credit

Explore These FeaturesTrack your credit score quarterly with our Credit Trends Tool. Make informed financial decisions with this secure and private feature right from our app!

-

Send Money with Zelle®

Explore Zelle®Pay back your friends or cover your portion of the bill quickly and securely with just an email address or U.S. mobile number.

What our members are saying...

Rashelle S.

Sarah M.

Monique M.

Checking Account Resources Just For You

Don't Get Hooked: Common Banking Phishing Scams to Watch Out For

Blog Highlights: Discover the Mechanics of Phishing: Understand the various tactics hackers use to target financial institutions and ...

Make 2025 a Standout Year with These 10 Life hacks That Can Have a Huge Impact

Blog Highlights: Learn how setting clear, achievable goals and prioritizing your mental well-being can give you the structure and ...

Holiday Shopping Crunch Time: 5 Ways to Shop Smart at the Last Minute

Blog Highlights: Prioritized Shopping List: Organize your gift list early to avoid impulse buys and ensure no one is forgotten. Online ...

Frequently Asked Questions

How do I make deposits into an Excel24 Jr. Account?

Just like you would at most financial institutions. Use any of our Finex ATMs, visit our branches, visit any Co-op shared branches, or use our mobile check deposit app.

What happens if I lose my card?

Report your card lost to our representatives at 860-282-0001 immediately. We can instantly issue a card at our Manchester or East Hartford branch locations.

The first lost card replacement is FREE. If you lose your card more than once, you will be charged $10.00 for each replacement.