New Member Checklist

To get the full benefit of being a Finex Credit Union member, complete this checklist and enjoy access to your money wherever you are!

- Activate & Use Your Debit CardAccess your money wherever you are through our surcharge-free ATM network, Mobile Wallet, and more! Learn More About Your Debit Card

- Sign Up For Direct DepositGet paid one day early and skip the paper check by getting your paycheck, social security, or other recurring check deposited directly into your account. Download the Direct Deposit Form

- Enroll In Online BankingFrom checking account balances to bill payments, make banking easier and more accessible with Online Banking. Enroll Today

- Download The Mobile AppDownload the Finex Credit Union Mobile Banking App to access your accounts, get account alerts, control your cards, apply for a loan, and more!

- Set Up Apple Or Google PayAdd your cards to a digital wallet and make purchases anywhere contactless payments are accepted. Explore Mobile Wallet

Register for Online and Mobile Banking Today

Enhanced Mobile Banking is at Your Fingertips

-

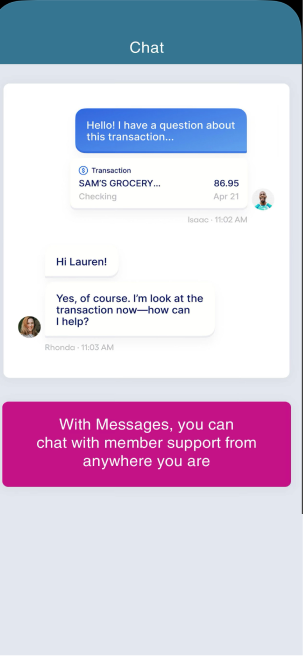

Chat With Us

Chat with our member support team in real-time through the Finex Mobile Banking App. It's safe, secure, and available for you wherever you are!

-

Send Money with Zelle®

Explore Zelle®Pay back your friends or cover your portion of the bill quickly and securely with just an email address or U.S. mobile number.

-

Control Your Cards

Avoid the hassle of getting a new debit card if yours is simply misplaced. Easily lock and secure your misplaced card and unlock it when you find it.

-

Monitor Your Credit

Explore These FeaturesTrack your credit score quarterly with our Credit Trends Tool. Make informed financial decisions with this secure and private feature right from our app!

Check Out These Great Ways to Save As A Member

Manage Your Money From Anywhere

Whether you need to send money, deposit a check, or pay your bills, Finex Credit Union has you covered! We make it easy for you to manage your accounts wherever you are!

Send Money With Zelle

Make A Mobile Deposit

Set Up Online Bill Pay

Upgrade To A Premier Membership

Premier Membership Perks

Our Premier Advantage Account and Premier eVantage Account are meant to reward our members for their dedication to Finex Credit Union. Members are automatically enrolled when they qualify.

Both Premium Accounts Offer:

- Unlimited FREE ATM Withdrawals at 55,000 AllPoint ATM Locations

- Shared Branch Access

- 1% APY Bonus Interest on Qualifying High Rate Rewards Checking Account

- 1% Discount on Loan Rates

- 50% of Fees Reduced or Eliminated

- Rate Premiums on CD, MMA, and Checking Accounts.

- Free Official Checks and Reduced Fees by Finex Credit Union on Use of Other Bank ATMs

Premier Advantage Additional Perk:

- $300 rebate of first mortgage closing costs.*

*$300 off closing costs for first mortgages requires a $100,000 minimum loan and cannot be combined with any other offer. Service fee of $15 per month if parameters not met.

Premium Advantage Requirements

The Premier Advantage account is for Finex Credit Union members who have both savings and loan products and/or balances.

Account Requirements:

Loan/deposit aggregate balance of $15,000*

Plus 2 of the following:

- Checking Account with Direct Deposit of $500 or more monthly.

- First Mortgage or Home Equity (with balance)

- IRA ($5,000 minimum balance)

- Money Market Account ($25,000 minimum balance)

*Aggregates are the total of all savings and loan balances combined. Credit Card balances are not included.

Premier eVantage Requirements

The Finex Credit Union Premier eVantage Relationship account is for members who prefer electronic transactions.

Account Requirements:

- Loan/deposit aggregate balance of $3,000*

- Checking Account with monthly Direct Deposit of $500 or more

- eStatements

- 12 Debit Card POS Transactions

Plus 1 of the following:

- First Mortgage

- Auto/Motorcycle/Boat/RV Loan

- Credit Card

- Personal Loan with Balance over $5,000**

*Aggregates are the total of all savings and loan balances combined. Credit Card balances are not included. **$5,000 personal loan cannot be met by aggregating multiple prior unsecured loans Service fee of $15 per month if parameters not met.