The Cashback Checking Account For You

Select the best Cashback Checking Account to fit your needs. With rewards and BONUS rewards, Finex Credit Union has the right Cashback Checking Account for you!

Cashback Rewards and Cashback Rewards PLUS Checking Offer:

Cash back with every qualifying Debit Card transaction you make in Connecticut and across the globe. Enjoy no monthly fees for qualifying members!

- Get Paid One Day Early

When you enroll in Direct Deposit you get paid one day early.1 - Contactless Payments

Use your Debit Card with a tap or add it to your mobile wallet for both Google Pay and Apple Pay. - Fraud Monitoring 24/7

Keeping your money safe around the clock.

1 Early access to direct deposit funds depends on the timing of the submission of the payment file from the sender.

Discover Your Perfect Checking Account

Discover the perfect Checking Account to suit your financial needs and unlock a world of rewards when you open your Checking Account online or in our Connecticut branches today!

Cashback Rewards Checking Account

- Earn $0.10 per qualifying Debit Card transaction2

- No Minimum Balance3

- No Service Charge3

- Free Online Banking

- Free Online Bill Pay

- Free Mobile App Banking

- Access to over 55,000 surcharge-free ATMs

Cashback Rewards Plus Checking Account

- Earn $0.15 per qualifying Debit Card transaction2

- Plus earn $0.25 MORE on transactions over $50

- Mobile device protection

- Free Online Banking

- Free Online Bill Pay

- Free Mobile App Banking

- Access to over 55,000 surcharge-free ATMs

2 When twelve (12) Finex Credit Union Debit Card transactions (excludes ATM transactions) post to the account during the Reward Period, you will receive Cash Back in the following amount: $0.10 cents per debit card transaction in the amount of ten ($10) dollars or more. The maximum cash-back payout amount is $10 per cycle. At our discretion, we may change the transaction requirements and reward amounts. Qualification Requirements to Obtain the Cash Rewards. **You must satisfy all of the following Qualification Requirements during each Qualification Period to obtain Cash Rewards. Have at least one (1) Direct Deposit (ACH credit will be accepted if direct deposit is unavailable to the member) in the minimum amount of $300. Sign up for eServices (including estatements, eNews, Homebanking) with a valid email address. You must have a minimum of twelve (12) Finex Credit Union Debit Card point-of-sale transactions or Signature (Qualifying Transactions) in the amount of $10 or more, posted to your account during the Reward Period. ATM Transactions are not Qualifying Transactions and will not be counted toward the minimum twelve transactions or be paid Cash Rewards. $10 Service Charge imposed if Direct Deposit Requirement is not met Cash Back Truth in Savings Cashback Plus Truth in Savings.

3 There is no minimum account balance or service charge if account qualifications are met.

The Best Checking Account in Connecticut

From application to managing your money daily, we keep the process simple and online for your convenience. No matter which Checking Account you choose, you'll always get:

-

24/7 Full Account Access Right at your Fingertips with Online and Mobile Banking

-

Get Your Paycheck One Day Early with Direct Deposit1

-

Access to over 55,000 surcharge-free ATMs & 5,000 Shared Branches

Open your Checking Account online today and experience The Finex Difference!

Open your Checking Account online:

1 Early access to direct deposit funds depends on the timing of the submission of the payment file from the sender.

Access Your Checking Account With Mobile Banking

-

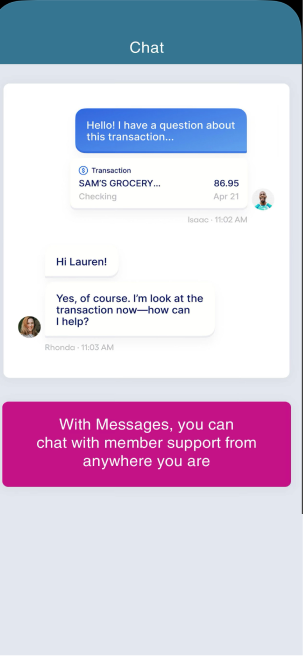

Chat With Us

Chat with our member support team in real-time through the Finex Mobile Banking App. It's safe, secure, and available for you wherever you are!

-

Send Money with Zelle®

Explore Zelle®Pay back your friends or cover your portion of the bill quickly and securely with just an email address or U.S. mobile number.

-

Control Your Cards

Avoid the hassle of getting a new debit card if yours is simply misplaced. Easily lock and secure your misplaced card and unlock it when you find it.

-

Monitor Your Credit

Explore These FeaturesTrack your credit score quarterly with our Credit Trends Tool. Make informed financial decisions with this secure and private feature right from our app!

We Have The Checking Account For You

Excel24 Jr. Teen Checking Account

Help your teen, between the ages of 13-17 years, build a solid financial foundation with our Excel24 Junior Teen Checking Account. They'll receive a Debit Card and access to our digital banking tools in order to gain the full banking experience.

- No Monthly Fees

- No Minimum Balance

- Bank Securely

- Debit Card with Surcharge-Free ATM Access

Excel24 Credit Builder Checking Account

This checking account helps build credit for the average 18-24 year old. We'll help you get started with the right tools to establish and build a strong credit score! Open your account online today.

- Get Paid One Day Early1

- Bank Wherever You Are

- Fraud Monitoring 24/7

Cashback Rewards and Cashback Rewards PLUS Checking Accounts

Start earning rewards and get cash back with every qualifying Debit Card transaction and no monthly fees for qualifying members!

- Get Paid One Day Early1

- Contactless Payments

- Fraud Monitoring 24/7

High Yield Checking Account

Earn premium rates, access your account from anywhere, and the perks keep coming! There are no monthly fees when you have a direct deposit of at least $300, complete at least 12 transactions of $1 or more, and sign up for eServices.

- Credit Monitoring

- No Monthly Fees

- Fraud Monitoring 24/7

Second Chance Checking Account

Whether you have a financial history that is less than ideal or experienced a sudden event that impacted your financial health, get a second chance with a Second Chance Checking Account. Rebuild your credit and get your finances back on track today.

- No Minimum Balance

- Low Monthly Fee4

- Free Debit Card

Add Your Cards to Your Mobile Wallet

- Fast

Stop digging your debit card from your pocket, purse, or wallet and pay faster from your phone or smartwatch. - Secure

No card information is stored on your phone, and your card number is not sent to merchants.

Google Pay

Apple Pay

Use Apple Pay on your iPhone, iPad, Apple Watch, or Mac to simplify your payments while paying on the go.

Contactless Payments

Simply hold your phone or watch near the card reader at any merchant where you see the contactless symbol.

What is a Checking Account and Why Should I Have One?

A checking account is a bank account designed for everyday transactions, like deposits, withdrawals, and bill payments. It helps you safely store and access your cash without the transaction limits Savings Accounts feature. Federally insured by NCUA, at least $250,000 of your deposits are safe and sound at Finex Credit Union!

- Eliminate the Need to Carry Cash

Use your Debit Card with a tap or add it to your mobile wallet for both Google Pay and Apple Pay. - Access Your Money Easily

Access your money through checks, debit cards, mobile apps, and online banking.

- Get Paid One Day Early

When you enroll in Direct Deposit you get paid one day early.1

What our members are saying...

Ed C.

Rose M.

Kristin J.

Checking Account Resources Just For You

Don't Get Hooked: Common Banking Phishing Scams to Watch Out For

Blog Highlights: Discover the Mechanics of Phishing: Understand the various tactics hackers use to target financial institutions and ...

Make 2025 a Standout Year with These 10 Life hacks That Can Have a Huge Impact

Blog Highlights: Learn how setting clear, achievable goals and prioritizing your mental well-being can give you the structure and ...

Holiday Shopping Crunch Time: 5 Ways to Shop Smart at the Last Minute

Blog Highlights: Prioritized Shopping List: Organize your gift list early to avoid impulse buys and ensure no one is forgotten. Online ...

Frequently Asked Questions

How can I get paid early?

By setting up for direct deposit through any of our checking accounts you can receive the deposit early. One thing to keep in mind is that early direct deposits depend on timing. Your payer must provide payment details on time so the deposit can process early. If your deposit doesn't arrive to us early, expect it to arrive on your scheduled payday.

How can I bank with you?

Although we have convenient locations available for service, you can use one of over 55,000 surcharge-free AllPoint Network ATMs and over 5,000 credit union shared branches nationwide. You can make deposits and withdrawals free of charge when you’re our member. Finex also has a variety of Mobile Banking functions, so we really can be wherever you are.

What if I had credit issues in the past?

If you have had an unfortunate experience with a checking account or credit issues in the past, we may be able to help. We are here to help you rebuild your banking journey through our Second Chance Checking Account. If you have questions feel free to contact us.