Understanding and Improving Your Credit Score

Your credit score is one number with a big impact on your financial life, so it's important you understand what it is, how it is calculated, and what you can do to improve it.

Establishing credit and maintaining good credit is important because it demonstrates to lenders that you are a safe bet for a loan, like for a car or mortgage. And the higher your credit score, the better interest rate you can qualify for.

What IS a Credit Score?

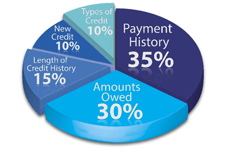

Credit reports are maintained by three reporting agencies: Experian, Equifax and Trans Union. Each agency calculates their own credit “score” by evaluating your payment history, your total credit limit and the percent of credit owed, how long you have had credit, the number of credit accounts you have, the type of credit accounts, your account payment history, and any new credit you have entered since you last did a credit report on your own. Of these, recent payment history and the amount owed will factor the most in any agency’s score.

Each agency has its own way of calculating a credit score, so it is recommended to check with all three of them for a full picture of your credit score.

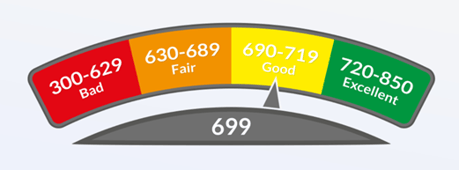

Credit scores run between 300 and 850. The higher your score, the more likely you are to get approved for a loan and to get the most favorable terms. In general, these are the “grades” for a credit score:

How to Get Your Credit Report and Correct Errors

The first step in understanding your score is to get a copy of your credit report. By law, the three credit reporting agencies must offer you a free copy of your credit report annually. To order your reports, visit annualcreditreport.com.

Review your credit report to identify any mistakes. The Consumer Financial Protection Bureau offers a list of common credit report mistakes to look for, including:

- The wrong name, phone number or personal address

- Accounts that belong to someone with the same or a similar name to you, but aren’t yours

- Accounts opened under your name by someone who stole your identity

- Closed accounts reported as still open

- Late payments that you made on time

- Incorrect balances or limits listed for accounts

- Same debt listed multiple times

Each agency has a process to dispute errors on your report: Experian, Equifax, TransUnion.

How to Improve Your Credit Score

No matter what your credit situation, Finex is here for you to help you understand and boost your credit score.

If you’ve ever been turned down for a checking account because of past banking mistakes, you may need a reboot to start to build a positive credit history. Finex offers Re-Start Checking, a second chance and opportunity for a fresh start with banking.

To build and improve your score, the most important strategy is to always (ALWAYS!) pay your bills on time. As shown in the pie chart, recent payment history gets the most weight in how credit agencies arrive at your score.

Types of credit is another factor credit agencies consider and they like to see a mix of credit types on your report. The two most common types of credit are revolving, like a credit card or home equity line of credit, and installment like student loans, mortgages, auto loans, personal loans, etc. If you are trying to build credit, or improve your score, getting an auto loan and making consistent payments can help.

Another aspect of your credit that is under your control and that can improve your score is credit utilization.

Credit utilization is the percent of your total available credit you are using. If you have a credit limit of $1,000 and a $100 balance, you have a 10% credit utilization. 10% is considered ideal for improving your credit score.

Paying your credit card balances in full each month will help keep your credit utilization low. Even if you can’t pay in full, reducing your total outstanding balance to 30% or less of your total credit limit can make a big difference.

When paying off credit card balances, or even making payments each month, be aware of credit utilization on each card and make payments strategically. Make the minimum payment on cards with utilization under 30% and a larger payment on any cards above that level. Once all your cards are below 30%, you can spread your payments more evenly.

Another way to change your credit utilization is by asking credit cards for a raise in your credit limit, which reduces the percent of total credit utilized. But this strategy isn’t recommended if overspending is already an issue!

Be a Credit to Yourself

Credit is like your reputation: something you build over time and that you want to protect. As a Finex member you have access to a variety of free credit score tools including:

- Annual credit score from Transunion uploaded to your online Account Summary page

- eFraud Prevention for tips on preventing identity theft

Finex credit union also offers members ongoing monitoring of your credit score with quarterly updates, web crawling technology, 24/7 ID theft support services and more through our Credit Protection Plus Program.