Finex Credit Union gets you to Better Banking

Ready to join a credit union that puts your financial success on the forefront? As a Connecticut resident, you’re eligible to become a member of Finex Credit Union, gaining access to personalized financial solutions, low rates, and expert support for your personal goals.

Our Focus Is To Make Your Life Easier

- Get Paid One Day Before Payday

Get your money one day early, always!* Finex Credit Union understands how important access to your money is! We float you the money – free of charge!

- Earn More For Your Commitment

We reward you for trusting your checking business with us and most of the time we will pay other banks’ surcharges, reward you with the highest deposit rates all with no minimum balances or fees as long as you actually use our debit card.

- Close A Loan From Wherever You Are

Our loan application process is quick and easy so you can apply from a device easily. We also do small loans for people just starting out when many other banking institutions won’t. We’ll offer you a start with no credit. It’s one of the reasons we’re here.

- Credit Score Enhancement and Counseling

We offer free credit score enhancement counseling and help you track your credit trends. We can even help you rebuild your credit after life deals you a set back!

*Early access to direct deposit funds depends on the timing of the submission of the payment file from the employer.

Enhanced Mobile Banking is at Your Fingertips

-

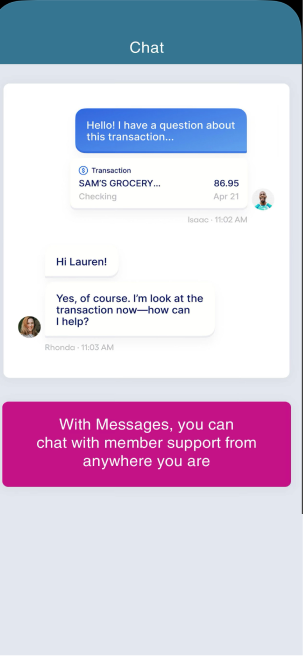

Chat With Us

Chat with our member support team in real-time through the Finex Mobile Banking App. It's safe, secure, and available for you wherever you are!

-

Send Money with Zelle®

Explore Zelle®Pay back your friends or cover your portion of the bill quickly and securely with just an email address or U.S. mobile number.

-

Control Your Cards

Avoid the hassle of getting a new debit card if yours is simply misplaced. Easily lock and secure your misplaced card and unlock it when you find it.

-

Monitor Your Credit

Explore These FeaturesTrack your credit score quarterly with our Credit Trends Tool. Make informed financial decisions with this secure and private feature right from our app!

Here's Who Can Join Finex Credit Union

Whether you're looking for credit unions or banks in CT, Finex Credit Union is your perfect match! In order to join you must open a Primary Share Savings Account with a minimum of $5 and fulfill one of the following:

- Live or work here.

If you live or work in Hartford County or Tolland County, you have what it takes to become a member! - Be a friend or relative.

Do know a friend or relative that's already a Finex Credit Union member? You are in luck! You qualify to join! - Be a part of an eligible business or group.

Do you work for an employer group of 500 employees or less in the state of Connecticut that provides Direct Deposit? If so, welcome aboard!

Becoming A Member Is Easy

Wherever you are on your financial journey, you can count on Finex Credit Union to help you every step of the way. Explore all the benefits our members receive and join today!

- Are You Eligible To Join?Uncover what Finex Credit Union members have in common by reviewing our eligibility requirements.

- Curious What You'll Need?Joining us is easy. You can complete your online application anytime, anywhere!

- Questions?We've got answers! Don't hesitate to contact us, we're happy to help!

Credit Union vs Bank: What's the Difference?

Trying to find the best bank or credit union in Connecticut? You aren't alone! Explore the core differences between credit unions and banks to gain an understanding of how you are helping or hurting your local community with your decision.

- People vs Profit: The Key Difference

Credit unions are not-for-profit, prioritizing members over profits, while banks focus on earning returns for shareholders. - Better Rates: More Savings

Credit unions generally offer higher deposit rates and lower loan rates than banks. Still unsure? Take a look at fees—credit unions charge only what's necessary, while banks often have higher fees to boost profits. - Be a part of an eligible business or group.

Do you work for an employer group of 500 employees or less in the state of Connecticut that provides Direct Deposit? If so, welcome aboard!

Join Finex Credit Union

What our members are saying...

Nana P.

Shanetta W.

Darren S.

Easily Switch Your Checking Account To Finex Credit Union!

No matter where your checking account is now, switching to a Finex Credit Union Checking Account couldn't be more simple! Download our quick Switch Kit Checklist with steps to close your old account, update your recurring payments, and button up any loose ends!